What is Debtor finance?

Debtor finance is an umbrella term that describes the process of financing through the sale of invoices to a finance company.

Factoring is a common example of debtor finance. It occurs when a business sells invoices to a third-party – or ‘factor’ – at a discount. Like debtor financing options in general, it helps businesses maintain positive cash flow, whatever their size or industry.

It should be noted that debtor financing “without recourse” is when the debtor financing company bears the loss of money owed that is not paid back by the debtor, whereas “with recourse” refers to the debtor financing company’s right to collect that unpaid amount from the company who has sold the invoice for financing.

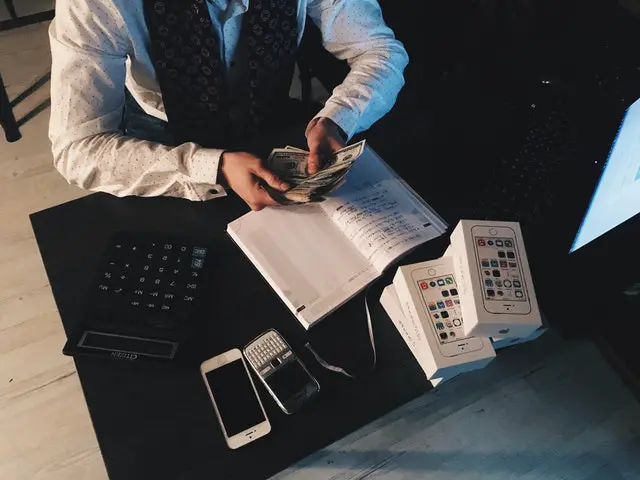

Get Fast Access to Your Money and Grow Your Business

Debtor finance can make a big difference to your business’ overall efficiency. You can purchase stock, pay staff and bills on time, get new equipment and scale your business up by making sure you’ve got immediate access to your money – all through debtor financing.

In addition to that, debtor financing companies do all the running around to get the money that’s owed to you – a task that would’ve taken up a lot of your time and energy as a business owner. It’s also an easier way to access than a business loan. If you’ve got good credit, chances are your business will qualify for debtor finance – no matter what size it is.

Debtor financing is an easy way to achieve your financial goals and focus on putting your money where it matters – but most importantly, having positive cash flow to help maintain your peace of mind!

Interested in Debtor Financing? Key Factors is Here to Help.

Key Factors is a debtor finance company that uses their extensive industry experience to make sure that delayed payments don’t slow your business down. They can give you up to 80% of your accounts receivable within 24 hours!

An independently owned, reliable and reputable company, Key Factors aim to ensure that delays in payments don’t hold your business back and offer flexible financing solutions to help you keep on track.

If you’d like to learn more about debtor financing as a financing option and how it can help your business, contact Key Factors today.