Like many other e-commerce verticals, fashion continues to grow. In fact, the estimated growth rate for last year was 17.2%, and would have been even higher if only all apparel retailers could figure out how online shoppers can select clothes that fit them perfectly without trying them on.

Yet there’s an even more fundamental problem with the online fashion vertical: card not present (CNP) fraud. Chargeback costs and fees unzip profits like nothing else, while false declines trim current and future revenue, as well as stunt future growth. Strict but simple fraud filters can cut down on chargeback costs but result in too many false declines. Both represent lost revenue which is unacceptable in a highly competitive industry like fashion.

So how can fashion retailers approve more legitimate orders while shutting out the fraudsters? For starters, they might want to consider rejecting the one-size-fits-all approach to evaluating an order’s data and learning the fraud patterns unique to the industry.

Keeping up with the trends (of fraudsters)

Let’s start with the order’s email address. One of the best predictors of a fraudulent order is the age of the email account supplied with the order. The general trend is: the younger the email, the higher the risk, with the decrease in fraud rate tapering off beyond 2 years. This is because fraudsters generally lack the foresight to create fake accounts long before the scam, as well as the patience, to hold onto those accounts for several months before using them.

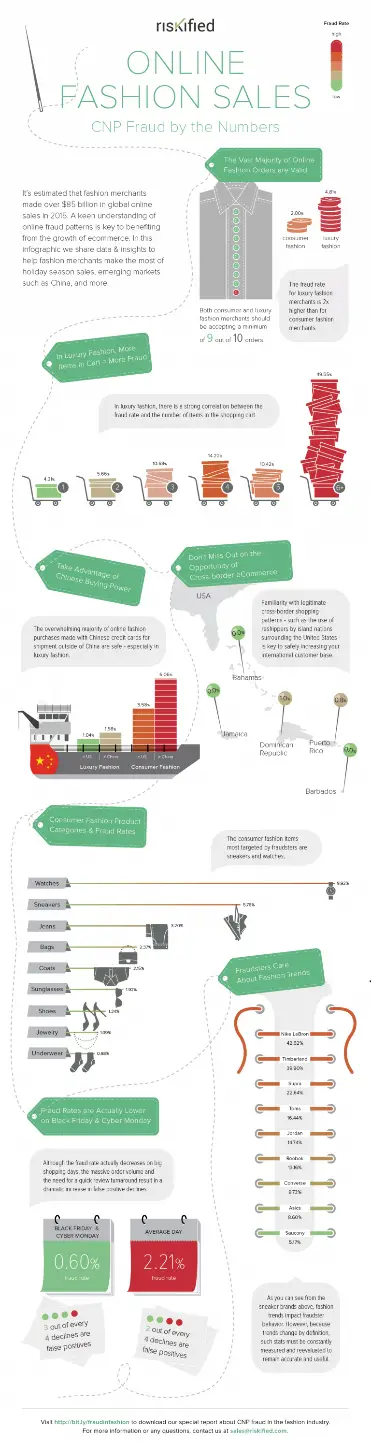

Here’s another strong correlation: the fraud rate increases with the number of items in the shopping cart. According to Riskified, the vendor of a machine-learning based fraud protection for ecommerce solution, if a shopping cart contains six or more high-end fashion items, the chance of fraud is just under 50%. This correlation makes a lot of sense given the “business model” of fraudsters, who seek to make the most money the fastest way possible. Each high-end luxury item has high value, and a large cart multiplies that value. The result: a single fraudulent order yields a huge profit when those goods are resold on secondary markets.

The infographic below highlights some other patterns Riskified sees from their customers’ data:

Source: Riskified

Another data point worth mentioning is the exceptionally low fraud rate for underwear. This category has less than a 1% fraud risk. It’s not hard to understand why the fraud rate for unmentionables is virtually unmentionable: items in this category are a lot harder to offload for a quick profit. Oddly enough, people are generally hesitant to buy underwear off Craigslist from a stranger.

Sarcasm aside, how can all this can be used to more effectively fight fraud in the fashion industry?

Don’t discount any of your data

As a first step, online merchants can use these statistics to better triage their current manual order review procedures. Orders of very safe categories (like underwear) can be approved very quickly and handled by the more junior analysts on your review team. This quick turnaround makes the whole shopping experience much more pleasant for your customers, increasing the chance they’ll do more business with you in the future.

Secondly, orders with strong indicators of fraud – like an email address only a month old together with a cart of 10 high-end purses – can either be routed to more senior analysts for extra scrutiny, or automatically declined (given the very low chance it was a legitimate order).

Here’s another takeaway: don’t base too much of your approve/decline decision on a single piece of data, like an AVS match, use of a reshipper or an IP proxy. You’ll notice that our above examples mention none of them, because we wanted to emphasize how other data points can prove just as telling. Bottom line: all the pieces of the puzzle need to fit together. This is precisely why holistic order analysis is both needed, and becoming increasingly fashionable.