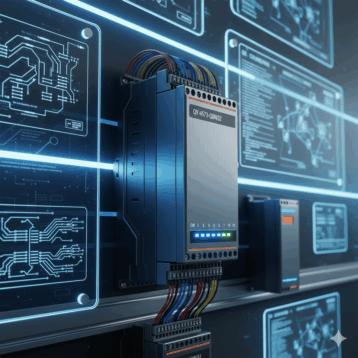

If the trend continues, 2017 may well be the fifth straight year of growth in funding for companies that are driving the Industrial Internet of Things (IoT). Last year alone saw a 21 percent funding increase within Industrial IoT, with over $2.2 billion across 321 deals, and a 5 percent increase in funding, according to CB Insights.

The attraction is no surprise, given that the IIoT is where significant potential for growth lies as technologies come together to create smarter, more efficient entities.

In addition to the funding of start-ups, overall investment in IIoT technologies and services is growing rapidly with few signs of slowing down. Through 2020, the industries that are expected to invest the most in this area are manufacturing, transportation and utilities. Last year alone, spending reached $178 billion, $78 billion in transportation and $69 billion in utilities, as these industrial sectors leveraged the deployment of intelligent, networked devices to operate smarter and offset risks.

But, IIoT applies to a lot more than just factories with sensors. Any industry that’s asset heavy but low on digitization is a ripe prospect. Among them: chemicals, mining, transportation, warehousing, construction and agriculture.

IoT’s potential has also led to a considerable amount of jockeying for position and doing so from every angle.

Consider, for example, that among the top investors of IoT startups are the venture funds of three companies who are prominent in either small chips or communications networks – Intel, QUALCOMM and Cisco.

There’s also been a surge in corporate IIoT dealmaking, and not just among tech giants. German machine maker Trumpf recently acquired C-Labs, an IIoT company whose latest software version imbeds IoT capabilities specifically geared to machine makers. The acquisition gives Trumpf a guaranteed source of supply to the technology it needs as it continues to enable a smart manufacturing environment.

Then there’s the approach taken by Quarterhill, an investment holding company formed this year from patent licensing firm WiLAN to acquire IIoT companies and nurture their ongoing growth. Two of Quarterhill’s initial acquisitions were International Road Dynamics (IRD), an established innovator of sensor systems for the transportation industry, and VIZIYA, a company that uses products like WorkAlign IIoT to improve reliability and maintenance of client assets.

New business partnerships within IIoT are on the upswing as companies join their innovative interests in their quest to help transform the industrial landscape. In recent weeks, for example, two new partnerships have been announced by GE for its Predix IIoT platform. One, a partnership with Microsoft, was an expansion of the integration of its cloud software with Predix’ applications. Earlier, GE and Apple announced an agreement for a new Predix software development kit for Apple’s iOS, so today’s mobile workers could access Predix functions through their iPhones or iPads.