Implementing a good time and attendance system into your business operations while significantly reduces time spent correcting payroll errors, is only effective if employees are using it properly. Payroll and accounting managers are consistently frustrated by the issue of inaccurate time reporting by employees. There are laws prohibiting companies from leveraging financial penalties against employees who do not comply with time and attendance keeping processes. The most organizations can do is fire employees and while it seems trivial to send team members job hunting over time and attendance tracking, it’s completely justified due to the potential legal ramifications of inaccurate payroll reporting.

Time and Attendance

Time and attendance are not synonymous with business operations. Time is the number of hours spent on projects, with clients, and non-billable tasks such as administrative house-keeping. Attendance is the starting and quitting time identified for peak productivity within the organization. While the time determines where the budget funds are coming from to compensate employees, the attendance determines how much an employee earns the amount of work completed.

Payroll Scope

Processing payroll is time consuming even in a one-person business effort which is why many entrepreneurs hesitate to grow their operations beyond that of a small business. Payroll doesn’t just include the paycheck amount that employees receive but also includes: vacation and accrual reporting, payroll processing, unemployment claims, direct deposits, retirement accounting, payroll tax reporting requirements, management reports, as well as time and attendance tracking. The National Small Business Association 2013 Small Business Taxation Survey says that more than 23% of small companies allocate over 120 hours annually to sort out employee tax issues without taking other payroll duties into consideration. Including the other seven standard tasks in the total payroll scope increases that annual figure exponentially. http://www.nsba.biz/wp-content/uploads/2013/04/Taxation-Survey-2013.pdf.

For enterprises with a global workforce, the complexity of payroll management escalates significantly. Our guide on payroll tax compliance offers invaluable insights for businesses seeking to streamline their payroll processes across diverse international jurisdictions, ensuring efficiency and regulatory adherence.

Management Impacts

If not completed timely, inaccurate payroll reporting impacts the tax reporting, retirement accounting, payroll processing, and in extreme cases the vacation accrual reporting. The domino effect of ongoing inaccurate and unresolved time and attendance reporting by employees can catastrophically impact operations management. Therefore, human resource and payroll leaders within your business must work together to come up with viable risk mitigation solutions for this common problem. Failure to do so will unenviably result in poor performance evaluations at those managers’ expense and impact their careers within your company.

Compliance Communication

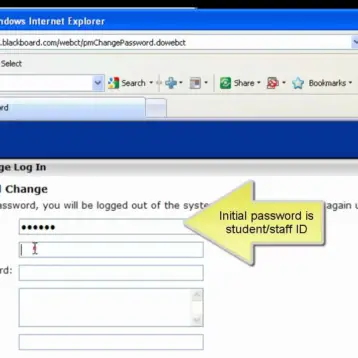

The most solvent way to hold employees accountable for adhering to time and attendance tracking processes is to have it in writing within a location that is highly visible to employees. Signage is key to providing daily reminders to staff that their first responsibility upon arriving to work is making sure to clock in. Deploying automated systems that send alerts to staff and managers is ideal. You can add that as a mandatory feature to the time and attendance system evaluation checklist and if you already have a system that doesn’t provide that feature, contact your IT department or person about implementing an easy to deploy digital reminder system until you can add the feature to your current platform. The employee handbook provided during onboarding should clearly outline the timekeeping policy and demonstrate the attendance tracking expectations.

Progressive Discipline

There is hope for payroll managers in minimizing the number of employees who forget to clock in and out, clock out early, or fail to accurately report time off. The recommended path of progressive discipline is a four-level process that if not halted will ultimately result in employee termination. Managers should begin with an informal verbal warning, escalating to a formal verbal warning, a written warning, and finally termination if the employee does not adhere to timekeeping standards. Ultimately, it’s impossible to force team members to follow company guidelines and unwillingness to do so is a key indicator that their presence in the workplace may be unnecessary.

Crucial Conversations

Mastering difficult conversations with employees are critical to helping them achieve great success within the organization, even when it comes to encouraging them to record timekeeping accurately. In these crucial conversations, it’s important to stick to the basic truths regarding the issue. In this case, the basic truth is that the employee made a time keeping error and that continuing to do so can result in job loss. Make sure to remind employees of the standard, the progressive disciplinary steps, and that they are a valued member of the team. Outside of listening to the employee explain what happened, there is not much else to convey in both the informal and formal verbal warning.

Document Employee Files

Every step to correct the employee’s behavior of failing to follow the time reporting policy should be clearly documented at the time of each incident. All progressive discipline measures should be recorded in the employee file and correction of the behavior only means that the progressive discipline steps are halted for the time being but can resume if the behavior does. For instance, if an employee complies with the standard after a written warning for the specified timeframe and begins failing to clock in after successfully avoiding termination, the progressive discipline should begin again. Employee management is not easy work and something as simple as the need to track time places huge demands on managers.

Creative Solutions

Incentives are a great way to influence employees to follow guidelines and procedures. It is feasible to reward the entire team for pay periods that are free from employee-based timekeeping errors. Other solutions include making it simple and easy for your team to follow timekeeping procedures, supplying the total team with instant individual rewards on the day payroll is due, and pairing stronger detail-oriented team members with more creative forgetful types when it comes to tracking time and attendance. At the end of the day, the incentives and rewards you supply to a team member for completing their payroll related records efficiently will be much more inexpensive than the time it takes for managers and their subordinates to correct the issues later.

Abstract: Payroll errors due to employees failing to report time and attendance timely are costly. This article outlines the impacts of poor timekeeping and creative solutions that managers can use.