Should you purchase a car, or should you lease it? This question is what many Americans have in mind when they consider getting a car. Dealer markups, inventory shortages, and production slowdowns make this decision even more challenging. Compared to previous years, there are fewer autos to lease this year.

Therefore, leasing an auto can be more expensive. However, there are certain benefits and downsides to buying and leasing. Here is what you need to take into account.

A Difficult Question: To Lease or to Buy

There are two ways to get a new vehicle: you may either buy or lease it. Every decision offers some advantages and drawbacks. Leasing is cheaper if you aim to purchase a luxury auto and make monthly payments.

Buying an auto offers fewer limitations on what you may do with your car and how much you may drive. Everything comes down to several factors: the sum you wish to spend, the miles you are about to drive, as well as the auto’s purpose.

Besides, consumers can utilize a calculator on the web to compute which option will work best for their needs. Every lending option comes with pros and cons. Debt is still debt and should be taken with full responsibility. You can review various lending tools on the FitMyMoney platform and compare your options.

What Is Leasing?

Let’s cover the basics of leasing. This is similar to renting an auto. The buyer doesn’t need to cover the full price of the vehicle straight away. It is great if you don’t have a lot of savings or cash to cover this big-ticket purchase.

A buyer is expected to pay the interest, fees as well as the amount of depreciation that might happen during the lease term. A down payment isn’t necessary to make, but some providers may ask for it.

The majority of car leases are closed-end leases. Monthly payments are needed to make till the end of the lease, together with interest. How long are the terms of the lease? It can be for any length, but typical leases are for about two or three years.

What Is Car Buying?

This is a more traditional way of getting a new vehicle. A price can be negotiated with the service provider. You need to take out an auto loan to finance this purchase, so the interest rates also apply.

The creditor holds the title of the auto until the loan is repaid in full. After that, the buyer gets the title and is free to do everything he or she wants with it. Various crediting institutions, online lenders, credit unions, and local banks issue car loans.

The borrower submits an application that can be approved by the lender. The loan is to be paid off in monthly payments, while lending conditions vary among lenders.

Who Is Leasing Best for?

This option works great for consumers who want to get an auto without paying too much upfront. Those who don’t have a lot of savings or cash to finance the car purchase right away but aim to get behind the wheel as soon as possible.

Leasing is a more affordable option and easier to manage. This way, you may even opt for a luxury car that you won’t be able to afford otherwise. Prospective wear-and-tear fees and mileage limitations need to be taken into account.

Who Is Buying Best for?

Do you prefer to manage your own purchases? If you have enough funds to make a down payment for a car and take out an auto loan, financing a car purchase can be a reasonable solution.

Additional homework should be done to fund a vehicle. Besides, you will face regular car loan payments together with interest. There is a benefit that the buyer has full control and may trade the car in or sell it at any time.

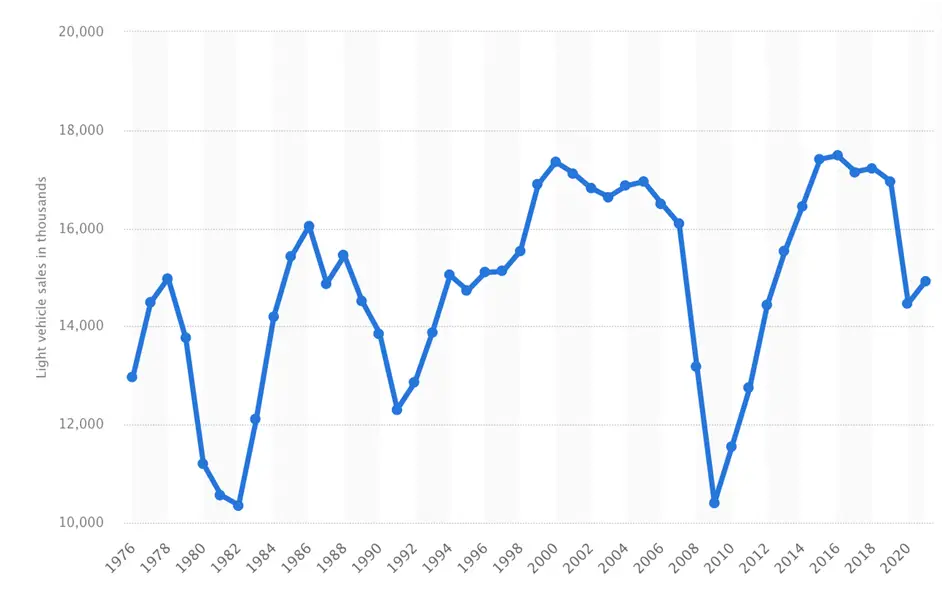

According to Statista, the auto industry in the USA sold about 14.9 million light vehicle units in 2021. If we compare light vehicle retail sales, there were 10,402.3 of them in 2009. This number rose to 14,926.9 in 2021.

Advantages of Leasing a Car

Here are some of the benefits of leasing an auto:

- It is easy to trade a car in.

- The latest technology with a new vehicle every few years.

- Ability to have a lower down payment.

- Ability to have some funds on sales tax.

- Lower monthly payments than a car loan.

Drawbacks of Leasing a Car

On the other hand, leasing has certain downsides.

- There is a mileage limit.

- You can’t own the car.

- You always have an auto payment.

- The ride can’t be customized.

- Gap insurance is required.

- Surprising lease-end expenses can add up.

- It can be challenging to obtain a lease with poor credit.

- Lease options are limited.

- The need to return the vehicle in good shape.

Advantages of Buying a Car

Here are some of the benefits of buying an auto:

- Ability to drive it as much as you want.

- Ability to own the vehicle right away.

- Ability to make the vehicle your own.

- Ability to get cash to fund your next vehicle.

- Ability to sell the car at any time.

- Financing a car is easier than leasing it.

- You will save more money in the long run.

Drawbacks of Buying a Car

On the other hand, buying an auto has certain downsides.

- The warranty will finish.

- A sufficient down payment is required.

- The future value of the vehicle is unknown.

- Interest rates are required to pay on the overall cost of the auto.

- Financing a vehicle is more expensive than leasing in the short term.

- More sales tax is required.

The Bottom Line

Hence, it’s up to you to decide whether you want to lease or finance a car. It depends on your driving habits, aims, and a thorough assessment of your finances. Consider the pros and cons of each option to choose wisely. How much can you afford to pay straight away? How many miles do you aim to spend driving the vehicle? Select the type of vehicle and answer these questions to choose the right solution.