Cash App, the popular peer-to-peer payment platform dominating the US financial landscape, is unfortunately unavailable in Australia.

But fear not, mates! The land of koalas and kangaroos boasts a vibrant fintech scene with several excellent alternatives offering similar functionalities. Pretty much all these amazing Cash App alternatives are functional, come with a myriad of features, and are worth using.

In this guide, we will provide a list of all the popular Cash App alternatives in Australia that you should consider checking out.

Does Australia Have Cash App?

No, Cash App is not available in Australia. Cash App, a mobile payment service developed by Block, Inc. (formerly Square, Inc.), is currently only available to users in the United States and the United Kingdom. While Australians can use other digital payment platforms like PayPal, Venmo, and local services such as Beem It or OSKO for their peer-to-peer payment needs, Cash App has not expanded its services to the Australian market.

Can Someone Hack Your Cash App With Your Name?

Top 10 Cash App Alternatives in Australia

While Cash App’s exact reasons for its Australian exclusion remain undisclosed, these alternatives ensure that users don’t miss out on the convenience of digital payment methods.

1. Revolut

Revolut emerges as a strong contender, offering a blend of features similar to Cash App. Enjoy instant peer-to-peer transfers within Australia, manage your finances through a user-friendly app, and even dabble in stock trading with limited commission-free options. Not just that, users can indulge in easy international transactions as well, further adding to its benefits.

Highlights of the app:

- With the best available rates, Revolut allows users to send money internationally with a few clicks of a button.

- It enables users to maintain multi-currency accounts, which is ideal for users who travel internationally.

- Revolut offers additional perks like lounge access, allowances for free ATM withdrawals, etc.

- Users can use a “no foreign transaction” fee debit card quickly.

- The comprehensive app gives you a detailed insight into your monthly spending.

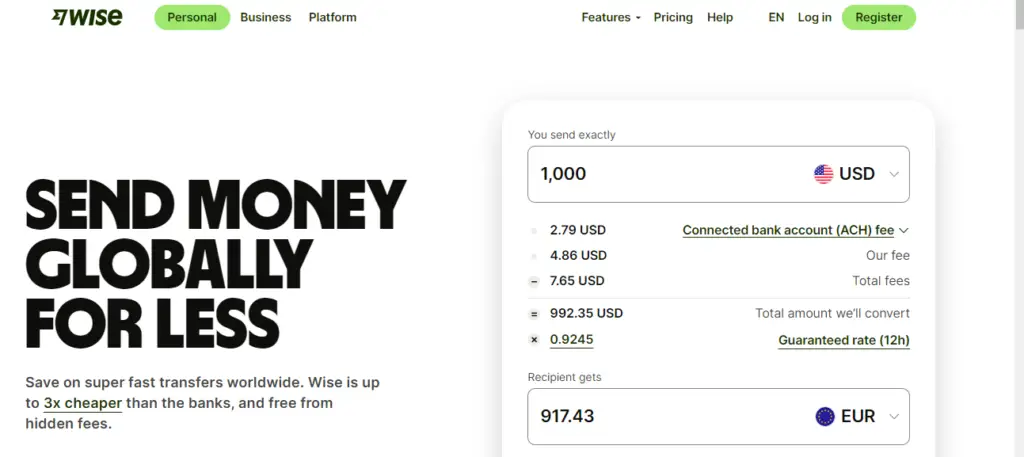

2. Wise (Formerly known as TransferWise)

If international transfers are your priority, look no further than Wise. Renowned for its transparent fees and competitive exchange rates, Wise makes it easy to send and receive money globally. While peer-to-peer transfers within Australia are possible, Wise might be more suitable for those managing international finances.

Highlights of the app:

- It is one of the few digital money transfer apps that supports 40 different types of currencies in the same account. For easy transactions, you get your AUD account details alongside the debit card.

- You get a mid-market rate concerning the currency market exchange, which is typically the best you can get.

- Have you wanted to receive money from other countries while living in Australia? Well, Wise takes care of that for you as well.

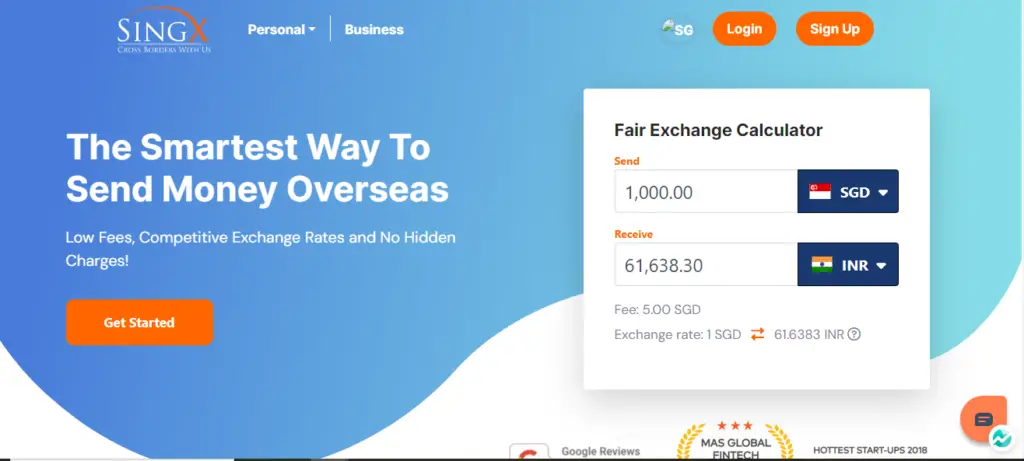

3. SingX

SingX excels in sending money specifically to the US and UK. It offers some of the most competitive exchange rates and transparent fees, making it an excellent choice for those with regular transactions across these corridors. They have expanded their reach, enabling users to send and receive money from India, Canada, and the Eurozone as well. With the best rates and convenient usage, this is hands-down one of the best alternatives to Cash App in Australia.

Highlights of the app:

- Seamlessly send and receive money from the US and UK, India, Canada, and Eurozone.

- Competitive rates ensure transparency and optimal economic choices for the app’s customers.

- Optimal security measures like multi-factor authentication secure your account as well.

- It is ideal for businesses and individuals who make bulk payments without high-end transaction fees.

4. Remitly

Have you been looking for a Cash App alternative in Australia through which you can seamlessly send money to your friends and family? If yes, then Remitly is the perfect choice. Users can currently send and receive money from Australia to the Philippines, Nepal, Pakistan, India, and Ghana. It specializes in fast and secure money transfers without any limitations.

Highlights of the app:

- Compare rates before sending to ensure you get the best deal. This is primarily because interest rates fluctuate, so it’s better to compare beforehand.

- The app allows various payment methods, including bank deposits, mobile wallet transfers, and cash pickups.

- To send money abroad, the platform supports same-day delivery, which comes in handy during times of emergency.

- Remitly currently focuses on developing markets, which is pretty off-beat compared to the competitors.

The Death of Cash (And Cards): How Mobile Payments Are Shaping the Future of Commerce

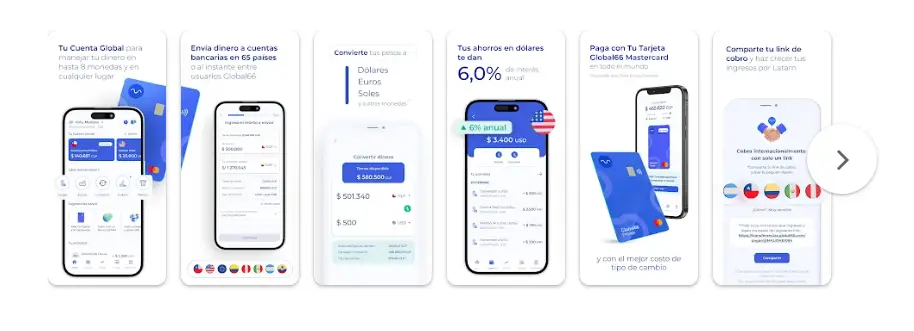

5. Global66

For those with financial ties to Latin America, Global66 stands out. It facilitates secure and affordable money transfers to various countries in the region. You can transfer money via Global66 in Colombia, Chile, and Mexico. They also offer competitive exchange rates and transparent transfer fees, which are the best in the market.

Highlights of the app:

- The main objective of the platform is to facilitate fast and affordable money transfers to countries in Latin America.

- The app has multiple payout options, including mobile wallet transfers, bank transfers, etc.

- The highlight of this app is how user-friendly the platform is. Sending and receiving money is a breeze, even if you aren’t tech-savvy.

- The dedicated mobile app enables users to keep track of their expenses and focus on keeping all the insights in one place.

6. Payoneer

While not strictly a peer-to-peer payment app, Payoneer caters to freelancers and businesses that receive international payments. It is currently operational in seven different currencies, including AUD, CAD, CNH, JPY, EUR, GBP, USD, etc. It enables users to freely transfer funds from one Payoneer account to the other. Except for a few regions, there are no additional fees involved. The platform’s currency conversion is 0.5%, which is also pretty decent.

Highlights of the app:

- Ideal for businesses, e-commerce, and freelances to access and send money.

- Global payment solutions for businesses with virtual accounts, international money transfers, and payment-receiving capabilities.

- Fast withdrawals from the Payoneer account without any interruptions.

- Dedicated customer support is available 24/7 to resolve any complications you might be experiencing while using the platform.

7. Currencyfair

Despite the limitations, this is your best bet if you are in Australia looking to send or receive money from the U.S. or South Africa. The app is also functional in the Eurozone and UAE. They boast competitive exchange rates and minimal transfer fees, making them a cost-effective option for these corridors.

Highlights of the app:

- Currencyfair offers some of the most competitive exchange rates for receiving USD and ZAR.

- With competitive rates, users can now send and receive money domestically and internationally, which is quite a benefit.

- There are no hidden fees or charges. Everything is out in the open and available with 100% transparency.

- The platform has robust security measures that ensure that your money and transactions are secure.

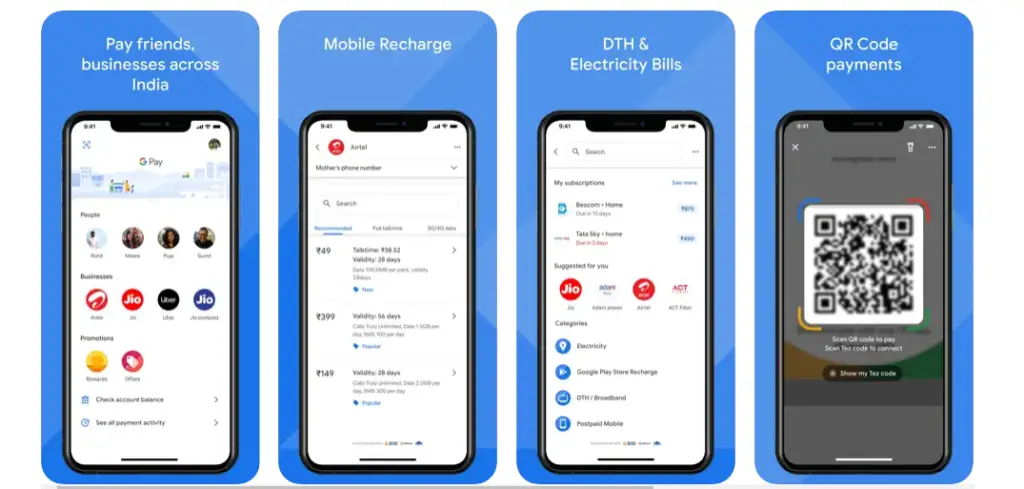

8. Google Pay

Google Pay is a mobile wallet solution that allows contactless payments at participating stores using your Android phone or smartwatch. While not specifically for peer-to-peer transfers, it’s convenient for everyday purchases. The highlight of this Cash App alternative is that it doesn’t charge the users for most transactions. So you can pay the amount and get on your way.

Highlights of the app:

- It is one of the most widely accepted payment apps used by retailers, online stores, etc.

- The app is functional on Android and iOS devices, and the UI is simple, enabling easy user experience.

- They offer a pretty unique rewards program through which users can be eligible to win cash rewards or discounts on certain products.

- There are multiple layers of security and encryption to ensure seamless transactions without any hassle.

- Contactless payments are easy to make, which is what Google Pay stands for, eliminating the need for cash and cards.

9. Apple Pay

Like Google Pay, Apple Pay is another popular contactless payment app enabling users to sort out payments and transactions with friends, families, and retailers. Users can also send money and receive them. It is currently compatible with the iOS ecosystem.

Highlights of the app:

- Enjoy a secure and convenient way to verify payments with your fingerprint or facial recognition.

- If you have in-app purchases for which you don’t want to use a debit or credit card, Apple Pay integrates into the app for easy payments.

- Rewards are associated with your transactions. To secure them, you’d need to link the loyalty cards with Apple Pay.

How Mobile Apps Can Help eCommerce Businesses Increase Their Sales

10. PayPal

A well-known online payment platform, PayPal offers a versatile solution for sending and receiving money domestically and internationally. While fees can be higher for some transactions than other options, PayPal’s global reach and established reputation make it a trusted choice for many.

Highlights of the app:

- It is a global powerhouse, enabling users to receive and send money with simple clicks. However, the conversion rate is also relatively low.

- For business transactions, PayPal offers buyer and seller protection, so if there are discrepancies, your money is not lost in the process.

- Convenient to pay your bills and manage your finances using PayPal and without any hassle.

- Offers various ways to hold funds, including linking your bank account or credit card.

Conclusion

Just because Australia doesn’t have a Cash App doesn’t mean you can’t indulge in seamless digital payments. These ten excellent alternatives are operational across Australia, enabling users to send and receive money, keep track of their finances, and streamline business solutions.