Selling a promissory note doesn’t have to be a daunting task. With the right preparation and the expertise of trusted note buyers, the journey from decision to sale can be both smooth and rewarding. With this guide we want to give you the right tools and understanding of how to sell a promissory note.

What Are Promissory Notes?

A promissory note is a formal, written promise between two parties outlining the terms of a loan or transaction. Unlike a casual IOU, a properly executed promissory note is a legally binding document, enforceable in its jurisdiction. These notes often accompany a mortgage or deed of trust, serving as the backbone of many real estate and business loan agreements.

Understanding the Secondary Mortgage Market

Definition and Importance

The secondary mortgage market is where existing mortgage loans and promissory notes are bought and sold between lenders and investors. Unlike the primary mortgage market, where loans originated, the secondary market allows banks and other financial institutions to sell mortgages, thereby freeing up capital to lend to more homeowners. This market plays a crucial role in maintaining liquidity and stability in the housing finance system, affecting interest rates, lending practices, and the availability of credit.

Why It Matters

For sellers of promissory notes, the secondary mortgage market offers several advantages:

- Increased Liquidity: It provides a platform for note sellers to quickly convert their long-term assets into cash.

- Market Efficiency: The secondary market helps standardize pricing and terms, making it easier for sellers to find buyers and negotiate fair deals.

- Accessibility: It broadens the pool of potential buyers, including institutional investors, enhancing the chances of a successful sale.

The Spectrum of Promissory Notes

While the essence of promissory notes remains consistent across the financial landscape, their applications vary. From consumer promissory notes for personal loans or property purchases to escrow notes blending principal and interest payments with tax and insurance escrows, the versatility of promissory notes is vast.

The Role of Promissory Notes in Today’s Market

In an era of fluctuating mortgage rates, promissory notes offer a flexible financing alternative for property transactions. They enable sellers to finance deals directly, bypassing traditional lending hurdles and opening doors for buyers with diverse financial backgrounds.

Reasons to Consider Selling a Promissory Note

Selling a promissory note can be a strategic financial decision for many reasons. Here are some of the most common motivations:

- Immediate Cash Needs: Sellers might need immediate access to cash for emergencies, major purchases, or new investment opportunities.

- Risk Management: Holding a note carries the risk of default. Selling the note transfers this risk to the buyer, providing the seller with a lump sum payment instead of uncertain future payments.

- Avoiding Management Hassles: Managing a promissory note requires ongoing effort, including record-keeping, tax reporting, and possibly dealing with late payments or defaults. Selling the note offloads these responsibilities.

- Estate Planning: Individuals planning their estates may prefer to liquidate assets like promissory notes to simplify their financial affairs or distribute assets among heirs.

- Market Conditions: Changes in the real estate market or interest rates might motivate a note holder to sell to lock in a profit or avoid potential depreciation.

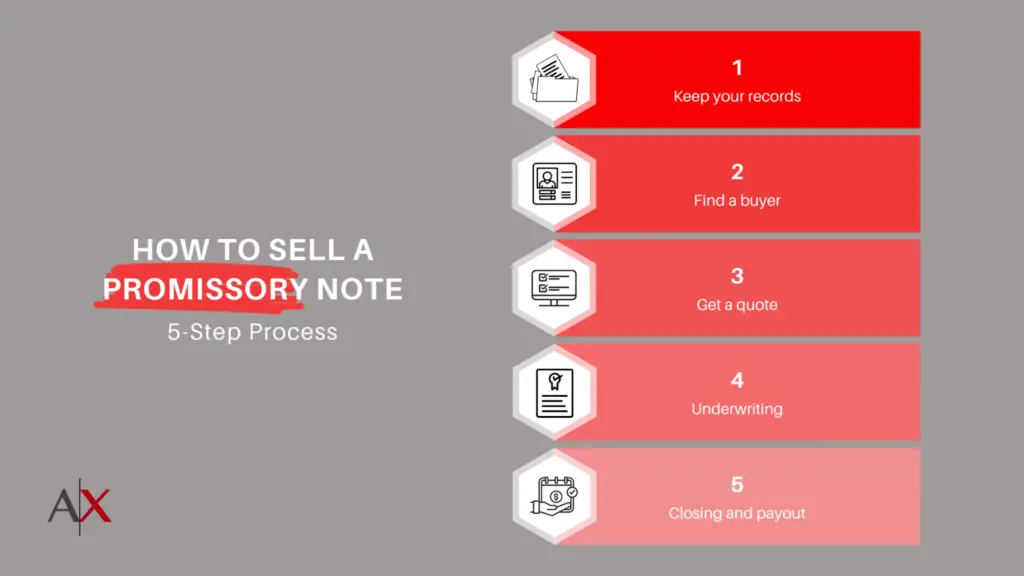

Selling a Promissory Note Process

1) Record-Keeping: The foundation of a smooth sale is meticulous record-keeping. From down payments to tax records, ensuring all transaction documents are in order is crucial.

2) Choosing Your Buyer: Whether selling to an individual, a family member, or a professional note-buying company, understanding your options is key. Professional buyers like Amerinot Exchange offer the advantage of experience and efficiency, often ensuring a quicker, more seamless transaction.

3) Securing a Quote: Preparing detailed information about your property and the note terms is the first step toward obtaining a fair quote. Expect to provide insights into the property’s value, the borrower’s credit, and the loan’s history.

4) The Closing Process: Upon agreement, the buyer will conduct due diligence, including appraisals and title searches. A reputable buyer will cover these costs, leading to a straightforward closing process, typically completed within 15 to 35 days.

Choosing the Right Buyer for Your Promissory Note: A Comparative Overview

When deciding to sell your promissory note, it’s crucial to weigh the pros and cons of each potential buyer type. This comparison table outlines key considerations to help you make an informed decision.

Each selling option comes with its unique set of benefits and challenges. Reflect on your immediate needs, the complexity of the transaction, and your long-term financial goals when choosing the path that’s right for you. Remember, engaging with a professional note-buying company can streamline the process, offering you peace of mind and financial liquidity in a timely manner.

| Buyer Type | Pros | Cons | Best For |

| Individual | Personal relationship potentialFlexible negotiation | Limited fundsLack of experience | Sellers with personal connections looking for a straightforward, potentially more flexible deal. |

| Family Member | Trust and familiarityPotential for favorable terms | Possible personal complicationsLegal and financial clarity is essential | Those looking to keep the property “in the family” or provide financial assistance to relatives. |

| Note-Buying Company | Professional experienceQuick, efficient processImmediate liquidity | Purchase at a discountLess personal interaction | Sellers seeking a fast, professional transaction with minimal hassle. |

FAQs for Promissory Note Sellers

Can I Sell My Mortgage Note?

Promissory note holders can sell their mortgage note to various kinds of investors, such as individuals, friends & family, or professional note buyers.

Do I Need a Lawyer?

While it’s not mandatory to involve a lawyer when selling a mortgage note, legal advice can ensure the sale’s integrity.

Finding a Reputable Buyer?

Unfortunately, it can be difficult to navigate the secondary mortgage market. It’s recommended to carefully vet the potential buyer. A good source are Google or BBB reviews.

About the Author

Abby Shemesh, co-founder and Chief Acquisitions Officer at Amerinote Xchange, brings over 25 years of experience in the mortgage industry, spanning both primary and secondary markets. His expertise, initially rooted in mortgage loan origination, evolved towards the secondary market and loan acquisitions in 2006.

Abby’s insights have been featured in top publications like Realtor.com, Investopedia, and Yahoo Finance, and he’s a recognized voice on platforms such as iHeartRadio and BlogTalkRadio. Additionally, Abby contributes as a faculty member at the Lorman Education Institute. His deep understanding of the complexities of note buying and selling makes him a trusted figure in guiding investors through the intricacies of the mortgage industry.