In today’s digital world, businesses rely heavily on seamless payment processing to keep customers happy and revenue flowing. But not all industries are treated equally when it comes to merchant services. Some are considered “high risk” due to their business model, transaction volume, or industry type. For these merchants, getting approved for a payment processor can be challenging.

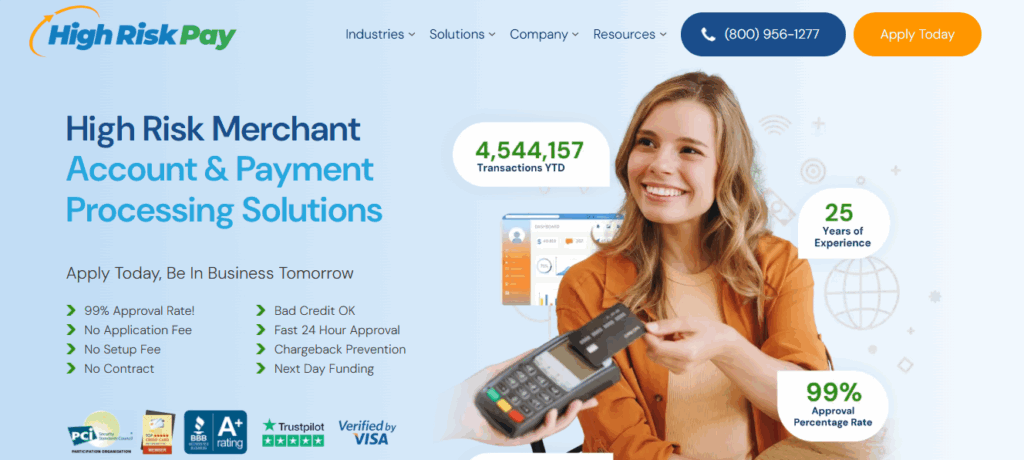

That’s where High Risk Merchant Account at HighRiskPay.com comes in. HighRiskPay.com specializes in providing tailored merchant accounts for high-risk businesses, ensuring they can accept credit card payments securely and reliably. In this article, we’ll break down what a high-risk merchant account is, why businesses need it, the features and benefits, and how you can apply through HighRiskPay.com.

What is a High Risk Merchant Account at HighRiskPay.com?

A high-risk merchant account is a specialized type of account designed for businesses that banks or traditional payment processors consider risky. This could be because of high chargeback rates, large average ticket sizes, or operating in industries prone to fraud.

Unlike standard accounts, a high risk merchant account at HighRiskPay.com comes with advanced risk management tools and flexible underwriting criteria. This allows merchants to operate without constant fear of being shut down due to their industry classification.

Is HighRiskPay.com the Best for High-Risk Merchants?

HighRiskPay.com is considered one of the more established providers for businesses labeled as “high risk,” especially in industries like CBD, adult entertainment, travel, and online gaming. They stand out because they specialize exclusively in high-risk merchant accounts, which means they are familiar with the unique challenges—such as chargebacks, stricter underwriting, and higher fraud risks—that many traditional processors shy away from. Their solutions often include faster approvals, chargeback protection tools, and flexible payment options, which make them a reliable choice for merchants who have been declined elsewhere.

That said, whether HighRiskPay.com is the “best” depends on your specific business needs. While they offer strong support and industry experience, their fees may be higher compared to standard processors, and some businesses might find better terms with other high-risk payment providers. For merchants who value stability, experience, and tailored risk management, HighRiskPay.com is definitely a strong contender, but it’s wise to compare offerings with competitors before making a final decision.

Top 5 Financial Challenges for Startup Businesses

Why Businesses Need a High Risk Merchant Account at HighRiskPay.com

Many businesses face rejection when applying for a standard merchant account. Payment processors often avoid industries like:

- CBD, vape, and cannabis-related products

- Adult entertainment and dating services

- Travel agencies and ticketing platforms

- Nutraceuticals and supplements

- Online gaming, gambling, or forex trading

- Subscription-based services

These businesses often experience higher chargeback risks, regulatory scrutiny, or cross-border transactions. A high risk merchant account at HighRiskPay.com helps them accept payments safely while keeping operations compliant and stable.

Key Features of a High Risk Merchant Account at HighRiskPay.com

HighRiskPay.com provides a suite of tools and features tailored for high-risk businesses:

- Multi-Currency Support – Accept payments from customers worldwide.

- Recurring Billing – Perfect for subscription-based businesses.

- Fraud Detection & Chargeback Protection – Proactive tools to identify fraudulent activity and manage disputes.

- PCI DSS Compliance – Industry-standard security to protect customer data.

- Flexible Payment Gateways – Integrations with popular e-commerce platforms like Shopify, WooCommerce, and Magento.

With these features, merchants can process payments smoothly and focus on growing their businesses.

Benefits of Choosing High Risk Merchant Account at HighRiskPay.com

Opting for HighRiskPay.com over traditional banks or processors offers several benefits:

- Faster Approvals – Get approved in days, not weeks.

- Reduced Account Freezes – Stable processing even in high-risk industries.

- Expert Support – Guidance on compliance, chargeback management, and payment optimization.

- Tailored Solutions – Accounts customized for specific industries and business needs.

By using a high risk merchant account at HighRiskPay.com, businesses gain financial stability and reduce the stress of unexpected disruptions.

4 Tips for Improving Your Deal Flow for High-Quality Deals

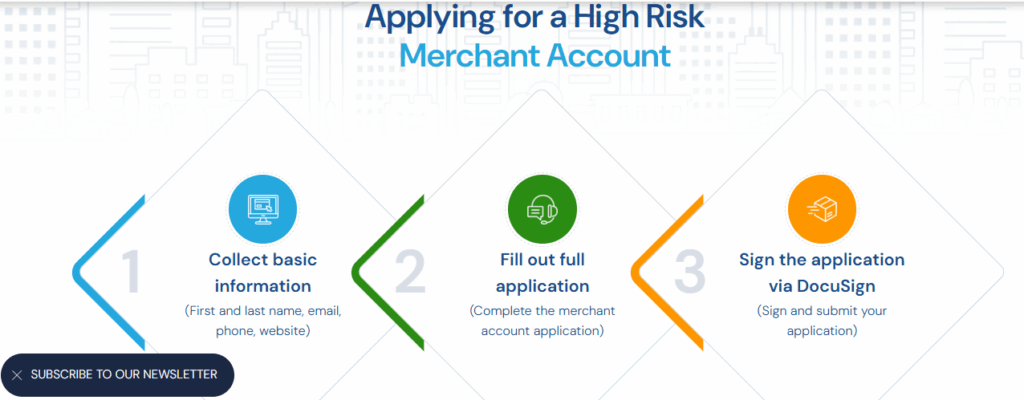

How to Apply for a High Risk Merchant Account at HighRiskPay.com

Applying for a high-risk merchant account may seem complex, but HighRiskPay.com makes the process simple:

- Submit an Application – Provide basic business details.

- Prepare Documentation – This usually includes ID, business licenses, financial statements, and previous processing history.

- Underwriting & Review – HighRiskPay.com assesses risk factors and ensures compliance.

- Approval & Setup – Once approved, you’re connected to a payment gateway and can start processing payments quickly.

Most applications can be approved within a few business days if all documents are in order.

Common Questions About High Risk Merchant Account at HighRiskPay.com

Why do processors label businesses “high risk”?

Industries with high chargeback rates, regulatory challenges, or cross-border transactions are often considered high risk.

Can I still get approved with poor credit history?

Yes, HighRiskPay.com works with merchants who may not qualify with traditional processors.

How does HighRiskPay.com handle chargebacks?

They offer chargeback alerts, fraud filters, and representment services to protect merchants.

What fees should I expect?

High-risk accounts may include higher processing fees and rolling reserves, but HighRiskPay.com ensures pricing is transparent and competitive.

Final Thoughts on High Risk Merchant Account at HighRiskPay.com

For many businesses, especially those operating in industries with added risks, having the right payment partner is critical. A high risk merchant account at HighRiskPay.com provides not only the ability to process payments but also the tools, compliance support, and expertise to keep your business running smoothly.

Whether you’re in CBD, travel, gaming, or any other high-risk sector, HighRiskPay.com offers solutions that fit your needs and protect your growth.